I’m delighted to have a new contributor on THCB today. Blake Madden writes an excellent health care business newsletter called The Healthy Muse, which I highly suggest you subscribe to. Recently he gave his take on Optum’s latest big acquisition and it’s the first of I hope many pieces of his we’ll run on THCB–Matthew Holt

by BLAKE MADDEN

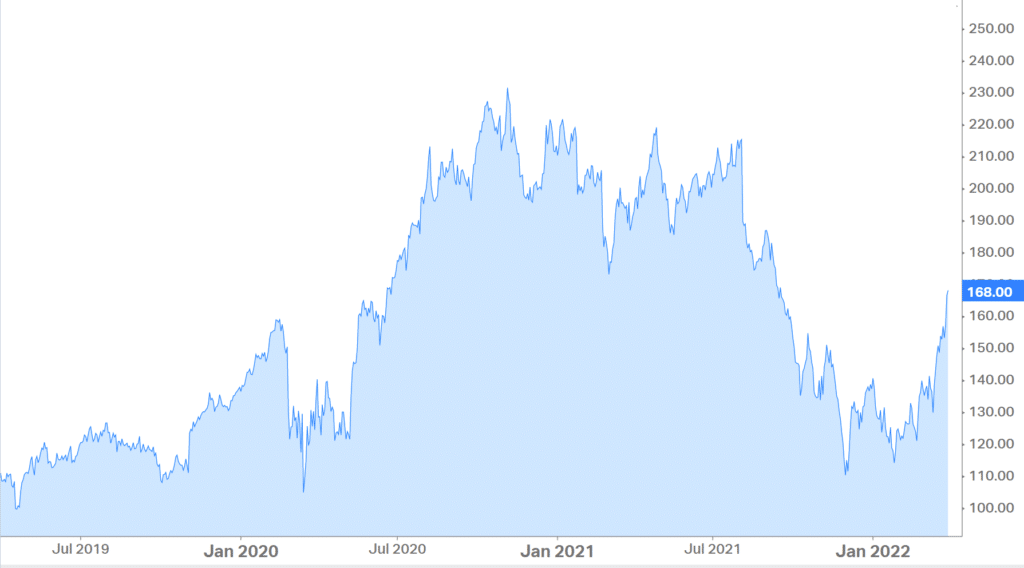

On March 29, UnitedHealthcare’s Optum announced its acquisition of LHC Group for $170/share. The transaction values LHC at about $6.4 billion including debt.

I know we all joke about working for UnitedHealthcare one day, but it’s terrifying when you think about their sheer scale. Even scarier when you look at Optum’s growth:

- Optum Revenue in 2012: $29.4 billion

- Optum Revenue in 2021: $155.6 billion. Like. What.

LHC Group is an important acquisition for Optum. Payors are continuing to morph into ‘payviders’ and UHG / Optum has a huge competitive advantage given its 60k aligned physician base. Acquiring LHC Group accelerates this payvider trend but also allows UHG to catch up to Humana, who now owns all of Kindred, in the post-acute sphere.

Meanwhile, Optum is deploying its grand vision of integrated care delivery right before our eyes. It’s happening whether you like it or not.

Even though I provided a first-impressions breakdown on Twitter related to the deal, I had to break this deal down into more detail and give you guys my thoughts on why the LHC acquisition is so significant.

Let’s dive in.

Investment and Deal Thesis.

LHC Group is well-positioned on a few fronts in the fast-growing home health sector:

- They’re partnered with 435 health systems, giving Optum access to hundreds of hospital joint ventures.

- Home health and at-home care is a MUCH more desirable care setting for Medicare beneficiaries. Comfort and patient experience is a huge factor.

- Of all post-acute care settings, home health is the most cost-effective. Home health costs way less than skilled nursing. Lower costs = lower medical loss ratio for United. By keeping patients out of SNFs and hospitals, these programs could disrupt facility-based care delivery in the coming years.

- From a demographics standpoint, home health benefits from an aging baby boomer population. Medicare will cover 79 million people by 2030 a major secular trend for healthcare. I’m sure you’re all WELL aware of that!

- PDGM and other headwinds for smaller agencies will run out of relief funding, resulting in consolidation. This consolidation will benefit larger home health platforms.

In summary, LHC Group is a great operator in a high-growth industry: Home Health.

First…some context on the Home Health Market.

Given increased patient desire to stay in the home for care, growing virtual care options from digital health players, the aging and growing Medicare population, the increasing negative stigma around nursing homes from COVID, and enhanced alternative payment models like the Hospital-at-Home (HaH) program, PACE, and other at-home care models, home health is just getting started.

- McKinsey estimates that $265 BILLION worth of care services conducted in clinics will shift to the home by 2025. That’s a four-fold increase over current home health care spending. Home health spending could double by 2030.

Fragmentation. LHC and other home health providers are benefiting from a fragmented market. Tuck-in acquisitions of smaller agencies are commonplace these days.

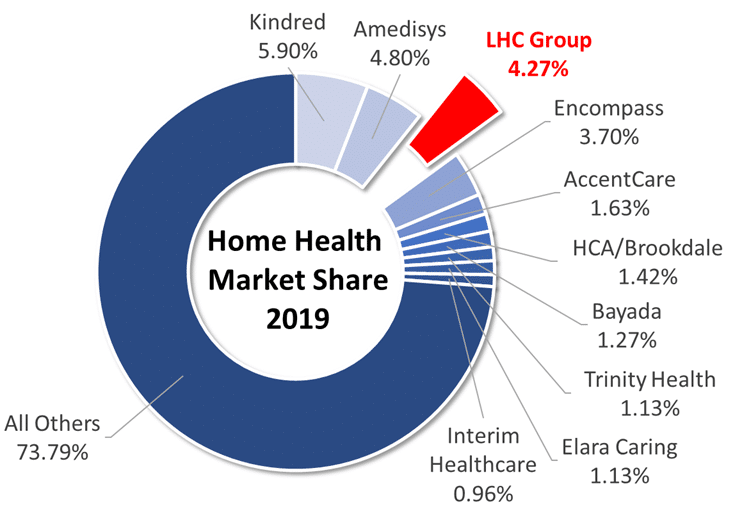

As of 2022, the top 5 providers account for about 21% of the total home health market share. This statistic indicates the significant opportunity for continued roll-up of the sector.

- Private equity has noticed this trend, too. Major PE players have entered both the home health and hospice markets to create platforms in the spaces. One recent splashy deal that comes to mind for me was Advent International’s acquisition of AccentCare in 2019.

Notable Deals in Home Health & Hospice

Home health has been one of the hottest M&A markets in healthcare services, both among large and small deals:

- The Ensign Group spun off its home health operations into the Pennant Group in about a $1 billion deal in late 2019.

- AccentCare merged with Seasons Hospice in November 2020.

- Humana purchased Kindred at Home for around $5.7 billion in August 2021 (for the remaining 60%) along with Curo Health Services in July 2018 for $1.4 billion.

- Optum purchased Landmark Health for around $3.5 billion (more on that below) in February 2021.

- Amedisys acquired Contessa Health – a major hospital-at-home provider – for $250 million in June 2021. When Amedisys made this purchase, they claimed it expanded their total addressable market from $44 billion to $73 billion. Do the math there, and that’s how big of an opportunity hospital-at-home could be! More on that below.

- HCA purchased 80% of Brookdale’s home health assets in a $400 million deal in July 2021.

- Encompass announced plans to spin off its home health assets into its own publicly-traded company. The post-acute firm rebranded the segment to Enhabit in Q1 of this year.

Not mentioned above is the plethora of home health, hospice, and home care deals taking place behind the scenes among private equity players, health systems, and publicly-traded operators alike.

It’s a great time to sell a home health and hospice agency, but it’s also a highly opportunistic time for larger operators to continue to roll up the space. Sector M&A activity is only going to accelerate from this point as platform players gobble up assets.

Background on LHC Group. Why Them?

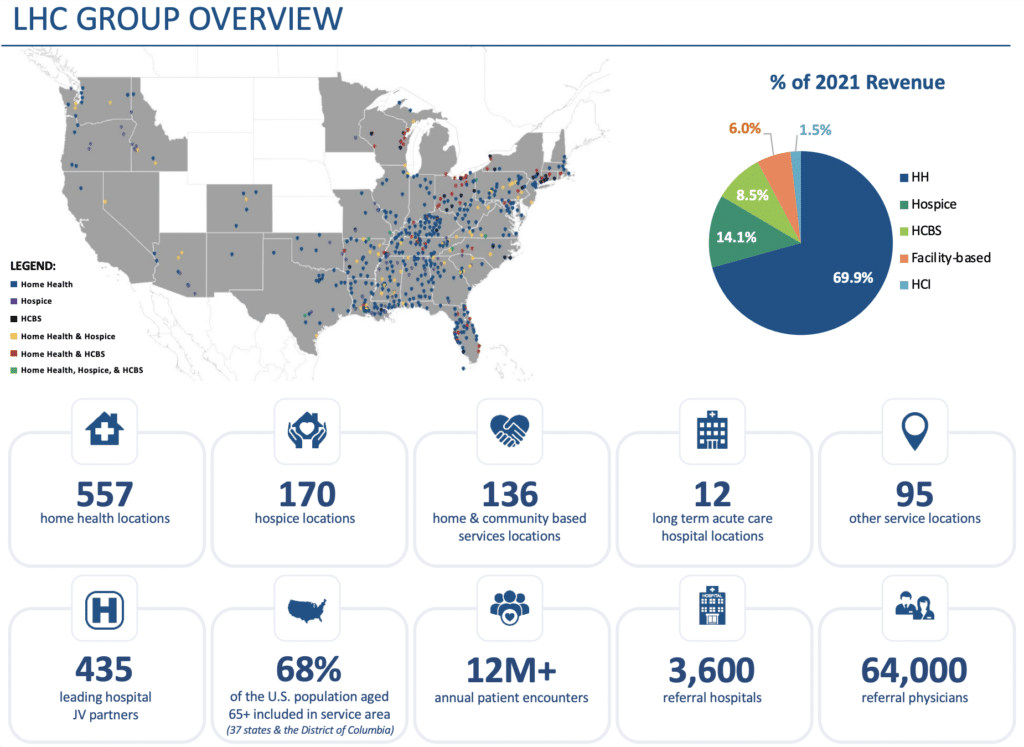

LHC Group is one of the biggest home health agencies in the US. After its founding in 1994, LHC Group’s business grew from a single home health agency into a $6.4 billion enterprise. The firm operates in 37 states through an impressive portfolio of assets across the spectrum that Optum can now take advantage of:

- 557 Home health agencies

- 170 Hospice locations

- 136 Home care locations

- 12 LTACHs

- The most underrated asset…30,000 trained clinical employees. During a labor shortage, Optum is creating a pipeline to out-compete all other healthcare service providers on staffing and talent.

At the last check, LHC Group holds about 4-5% of national market share. That’s good enough to be the third largest national home health provider behind Amedisys and Kindred. Since its inception, LHC has grown through tuck-in acquisitions, JV partnerships, and organic market share retention from solid execution.

In 2017, LHC Group merged with fellow public home health operator Almost Family in a $2.4 billion deal at 14x EBITDA.

- For context, LHC sold to United this month for 2.4x forward revenue and around a 21.4x forward EBITDA.

More recently, LHC purchased 47 locations from Brookdale as part of the planned divestitures included in the HCA-Brookdale $400 million deal.

Yes, multiples in home health are FROTHY but justified given the coming growth. Home health & hospice boast the highest EBITDA multiples in healthcare. Of course, that excludes the slight nonsense going on in digital health.

While LHC has succeeded in its M&A strategy, its ability to integrate and operate those assets has resulted in even more success.

LHC’s Strategy and Secret Sauce.

As mentioned, LHC prioritizes partnerships with hospitals and health systems when approaching markets. These partnerships vastly increase LHC’s chances of market viability and success.

By partnering with hospitals in local markets, LHC locks in large market referral sources from affiliated facilities and leverages that captive volume to out-compete other market players. The partnership doesn’t reimbursement hurt rates, either – even though most home health recipients are on Medicare.

- As of March 2022, LHC held partnerships with 435 hospitals and health systems, receiving referrals for services from 3,600 hospitals across their geographical footprint.

The strategy results in a healthy bottom line. Last year, LHC generated about $2.2 billion in revenue and $216 million in EBITDA (10%ish margin).

Before the acquisition, LHC guided to $2.5 billion and $280 million in EBITDA (margin expansion to 11.2%). The firm is well-positioned and capitalized for growth. Given home health’s capital-light model, LHC holds a solid balance sheet slated to overcome short-term labor and inflation challenges.

- On labor issues, LHC has noted that employee turnover is well below home health industry averages, which speaks volumes (literally) about its operational excellence. More staff = more census = more cash monaaay.

I’m somewhat surprised they sold to United for a low premium (~8%) given their bullish rhetoric around short-term challenges. When discussed on the deal call, though, Optum mentioned that the initial share price premium was around 25% prior to LHC’s recent surge in pricing. Overall, LHC’s share price has suffered since July 2021. Side note – did someone know something starting in January?

Fishy.

How Optum can unleash LHC Group.

So, we’ve established that home health, home care, hospice, and other post-acute services that LHC Group offers have a growing place in healthcare in the coming years. LHC Group was already doing a great job executing its growth-through-JVs strategy from a long-term perspective.

Optum and UHG can unlock value one step further by integrating LHC’s post-acute services into Optum’s continuum of care. That continuum includes an impressive portfolio of acquired post-acute assets. In the past few years, Optum has invested HEAVILY in its at-home care programs by launching a slew of new services and aggressively acquiring key players in the home and virtual care sector:

- Launched Optum HouseCall (1.6 million visits in 2020);

- Acquired Landmark Health in 2021 for around $3.5 billion, which is a direct contracting entity and is involved in hospital-at-home and other value-based programs;

- Acquired naviHealth, a post-acute management services and care navigation platform, in an alleged $1 billion + deal;

- Launched a virtual first plan in October 2021 called NavigateNOW;

- Acquired AbleTo for just south of $500 million, a virtual therapy provider

Aside from the post-acute vertical, UHG acquiring key assets in adjacent markets as well. Some recent, notable deals:

- Bought Change Healthcare for ~$13 billion (assuming the deal goes through pending antitrust investigation. It might not given recent rhetoric, but the burden of proof is on the government)

- Rumors of the Refresh Mental Health deal for likely $1 billion+

- And now the acquisition of LHC Group for $6 billion+

Coupled with the above acquisitions, UnitedHealthcare has repeatedly echoed positive sentiment for Optum. Optum is, after all, United’s primary vehicle for growth in the coming years.

More specifically, United has grown more and more bullish on the expansion of home health services. Just take a look at UHG‘s CEO Andrew Witty touching on Optum’s bullish thesis for at-home care during United’s Q4 2021 earnings call. We should have been paying attention!

“I’ve been super impressed with the development, not just in the clinic, but also through the at-home programs, where we’re able to continue to make sure folks are looked after properly. And actually, particularly as we’ve gone through the pandemic environment, people’s preference to have care delivered in the home has become clearer and clearer.” – Andrew Witty, UHG CEO, Q4 Earnings Call

When interviewed for deal comments after the LHC Group acquisition announcement, Wyatt Decker, the CEO of Optum, doubled down on Andrew Witty’s comments, touting the demand for at-home care.

“This trend has really only just begun, of how much care can truly be delivered in the home…We can give care in the home, which is a lower-cost setting…than nursing homes or more advanced care facilities.”

Through Optum, UHG can keep patients out of costly facility-based care settings like SNFs, IRFs, and even hospitals. This care coordination allows UHG to better manage medical costs long-term. UnitedHealthcare can and will continue to offer competitive insurance plans and services by leveraging Optum’s 60k physicians and 2k sites coupled with these new post-acute and new virtual care assets. Pretty powerful synergy, if you ask me.

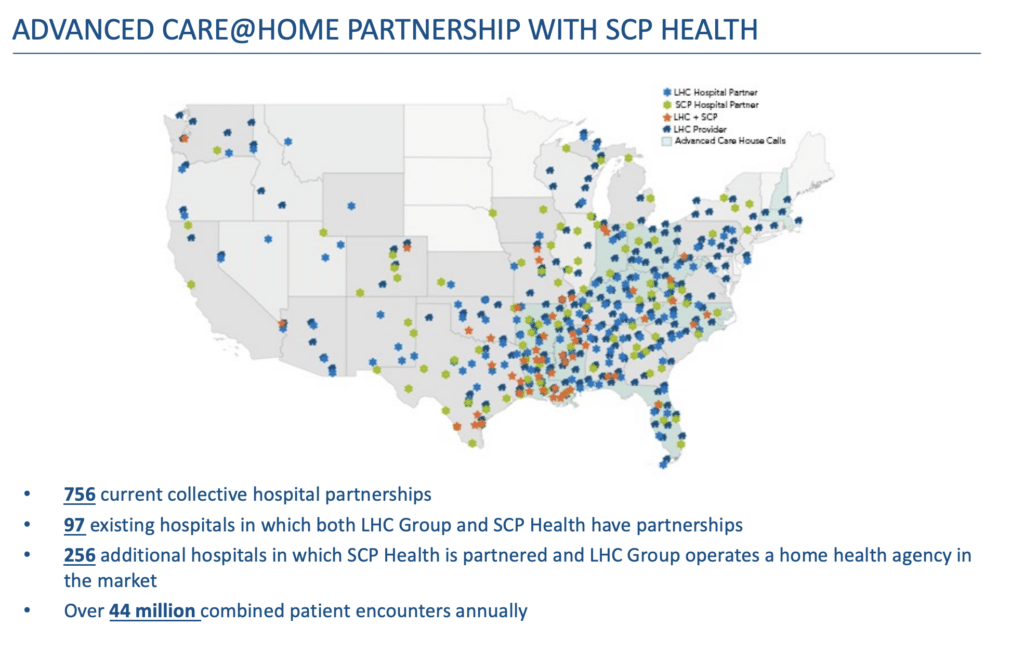

In addition to the above assets at Optum’s disposal for post-acute strategy, LHC also announced a huge partnership with SCP Health in mid-2021 to vastly increase SNF@ Home and HaH programs nationwide. The partnership combined LHC’s home health workforce with SCP’s 7,500 clinicians to create a widespread Advanced Care at Home program.

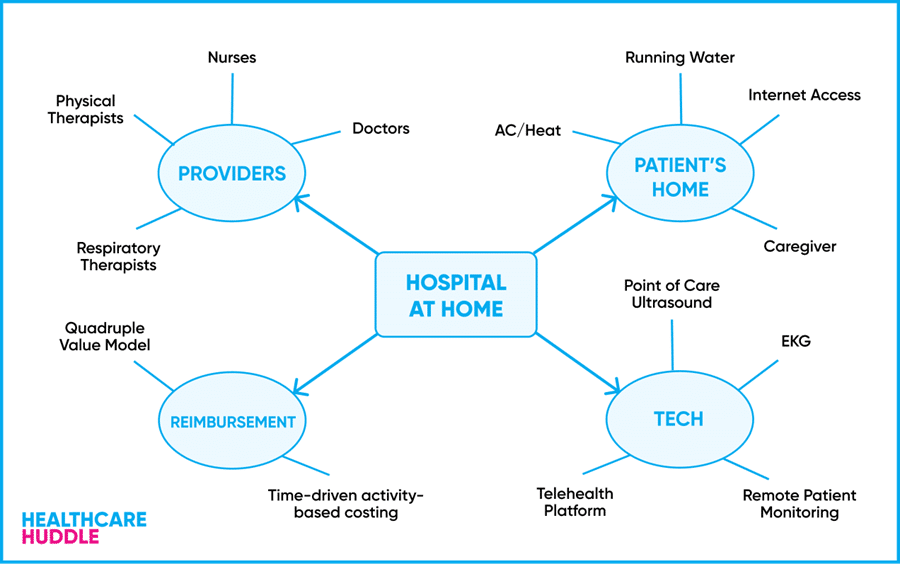

- Optum can leverage LHC’s existing hospital partners to scale hospital-at-home and skilled-nursing-at-home programs – value-based care programs that are just beginning to ripen. If effective, the giant could disrupt these traditionally facility-based services significantly. Take a look at LHC’s existing HaH and SaH model.

If LHC can deploy the above footprint with SCP’s 7,500 clinicians, just think how LHC Group and Optum can scale Advanced Care @ Home with 60,000+ physicians and other clinicians.

- Starting to get it? Strategies like these are how Optum will realize incredible deal synergy from this acquisition – if executed successfully.

This is just the beginning of home-based care initiatives. Other emerging home care segments include home infusions, home-based dialysis, and primary home care – all of which are future avenues of growth for Optum.

Home Health is favored positively in Congress.

Multiple legislative packages increasingly favor at-home care and new value-based programs in the home health sector. Here are just a few programs and bills that signal strongly in favor of future growth for home health:

Choose Home Care Act of 2021: The bill was introduced in Congress late last year and would allow Medicare beneficiaries to be given the option to choose to recover at home rather than in a setting like a skilled nursing facility (Factsheet)

Public Health Emergency Provisions: The PHE created a lot of positive externalities for at-home care. Currently, the PHE will expire on April 16 but will likely be extended for another 90 days, which would maintain the following provisions for post-acute care specifically:

- Medicare sequestration suspension (AKA, better reimbursement that might be permanently delayed)

- Relaxed admission rules and delayed site-neutral payment implementation for LTACHs

- Interestingly, the PHE and associated relief dollars from the CARES Act kept struggling agencies afloat during the pandemic when they otherwise would have gone out of business or sold. CARES Act relief payments, accelerated payments from Medicare, and paycheck protection program loans helped bolster small agency balance sheets during the volume dry spell.

HaH and SNF@H: Hospital and Skilled Nursing At-Home programs are receiving bipartisan support in Congress and will likely get extended another two years with widespread health system backing through the Hospital Inpatient Modernization Act or similar legislation.

Home Health CMS Reimbursement: For 2022, CMS instituted a basket rate increase of 2.5% and no cuts; I would expect even higher basket rates for 2023 and likely an adjustment to the wage rate calculation to account for inflation trends.

- The 2022 final rule will expand the Home Health Value Based Payment demonstration from 9 states to all 50 (!!!)

PDGM: The Patient-Driven Groupings Model, AKA, PDGM, was supposed to shake up the home health industry during its implementation in 2020. Here’s what PDGM changed and why smaller operators will struggle post-’Rona:

- PDGM created a 30 day payment period and based those payments on how patients were classified into 432 distinct payment groups. These payment groups are further broken down into 5 dimensions of care, including referral source, period timing, clinical conditions, functional status, and comorbidities.

- What YOU need to know about PDGM is that the payments are no longer based on volumes, or the number of in-person therapy visits provided. Previously, the prospective payment system would INCREASE payments as the number of therapy visits for that patient increased. But no longer.

- Along with the decoupling from visit volumes, home health agencies can no longer request advanced payments (RAP) from Medicare (AKA, “pay us upfront and we’ll figure out the differences in payment later”). Before CMS phased this out, providers could receive 50-60% of total payments upfront by submitting an RAP. RAPs were replaced by Notices of Admissions (NOAs) starting in 2022.

- So now, instead of receiving that large upfront payment, home health agencies get nothing, which hamstrings cash flow quite a bit. As we say in business school, Cash is King.

As a result of current inflation headwinds, labor shortages, and cash flow changes, I’m expecting smaller home health agencies to struggle post-’Rona. These dynamics will cause them to sell to bigger players…kind of similar to how independent physicians sold to health systems and private equity given operational struggles during the pandemic.

Before the pandemic, the sentiment regarding PDGM heading into the major changes was that the program would cause unprecedented levels of consolidation, echoing my thoughts above:

“Combined with the two 30-day payment periods under PDGM, the elimination of the RAP should lead to more consolidation in the industry than we’ve experienced in the last 2 decades. It will hit cash flows hard for the smaller agencies; but for the larger agencies, such as LHC, we would expect minimal impact.” Keith Myers, Co-Founder, Chairman & CEO, LHC Group Q3 2019 Earnings Call

“We believe PDGM has the potential to accelerate an industry consolidation unlike any we’ve seen in recent memory. We will be ready” Keith Myers, Co-Founder, Chairman & CEO, LHC Group Q3 2019 Earnings Call

In summary, we haven’t seen these effects yet on smaller home health operators because of the easy money public health emergency policies. But eventually, we’ll find out if Keith was right. I bet he is.

Conclusion

There are WAY too many positive dynamics at play in favor of LHC Group’s portfolio of assets for you to ignore Optum’s acquisition:

- Regulations are supporting home-based initiatives, and reimbursement is stable. Lawmaker scrutiny is mounting on SNFs, providing further discharge opportunities and advancement for home health.

- LHC has a history of operational success in home health and is the missing link among Optum’s various post-acute and at-home initiatives. Optum needed this acquisition to keep up with Humana and others pursuing similar post-acute strategies.

- Home health is highly fragmented and PDGM creates headaches for smaller agencies, which will allow Optum to pounce on opportunistic M&A in the space.

- Along with its huge physician base, Optum can leverage LHC’s health system partnerships to drastically expand Advanced Care at Home programs combined with recent acquisitions of Landmark and naviHealth.

- By keeping patients out of SNFs and hospitals, these programs could severely disrupt facility-based care delivery in the coming years through the home.

Final thoughts on antitrust…You could argue that there are antitrust concerns related to this transaction given that UHG is essentially creating a vertical monopoly, and I get that.

- I would argue that the deal is a win for most parties involved, including patients, health systems, and keeping patients out of costlier care settings while receiving effective treatment at home. If Optum doesn’t abuse its position (which is a big if, mind you), I have no problem with the increasing vertical integration in healthcare.

Down the line, I would not be surprised whatsoever if regulators forced United and Optum to split.

But for now, watch out for this scaled healthcare titan.

Blake Madden is the founder of The Healthy Muse and is also a manager at VMG Health

More Stories

Stair Running Workout! Boost Testosterone – Build Muscle!

Is That Beer Belly Causing Your Back Pain? The Truth May Shock You

Permanent Cure For Back Pain